In a strong signal

to the growing regional stature of AIT’s nascent Professional Master’s

in Banking and Finance (PMBF) Program, two of Asia’s senior most

bankers graced the second Completion Ceremony of the program held on 15

December 2012, addressing diplomats, dignitaries, graduates and AIT

officials in Bangkok.

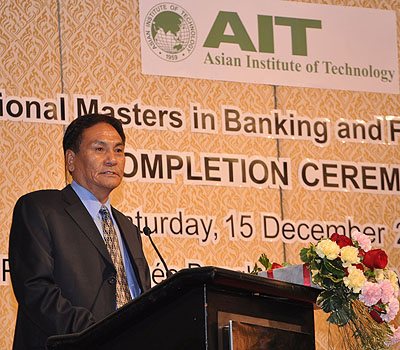

Mr. Daw Tenzin,

Governor of the Royal Monetary Authority of Bhutan (RMB) and Mr. Md.

Ahsan Ullah, Executive Director of Bangladesh Bank, spoke on banking

and finance perspectives of their respective countries and globally as

they witnessed 26 of their countrymen and women receive completion

transcripts for their degree.

A total of 16

students from Bangladesh and 10 students from Bhutan will be conferred

their degree from the School of Management, AIT, at the

118th Graduation Ceremony on December 18. Employees of

Bangladesh Bank and the Bank of Bhutan, the tight-knit class of

mid-level managers completed the 9-month program run by AIT Extension

while on extended leave from their jobs, living and studying on

campus.

Extending words of

congratulations and thanks on behalf of AIT President Prof. Said

Irandoust, AIT Extension Executive Director Dr. Jonathan Shaw

emphasized the special relationship AIT shares with both countries in

terms of partnership for elevating professional skills and human

capacity. The PMBF is an innovative attempt at banking and finance

education that emphasizes banking for positive development which seeks

to avoid the mistakes of the recent global financial crisis, he

said.

Calling the Asian

Institute of Technology “a very special institute”, Governor Tenzin was

matter-of-fact in his assessment of the PMBF and of AIT’s ability to

educate his staff in this highly specialized subject. “Banking is a new

business in Bhutan, and the challenges of banking and finance are

enormous,” he said. “AIT is an option for our central bank.”

The Governor of RMB thanked H.E. Mr. Kesang Wangdi, Ambassador

of the Kingdom of Bhutan to Thailand, for his support

for the program, and wished the graduates well in their careers. He

told them to keep learning, think like a banker, focus on credit and

debt issues, and be vigilant in one’s knowledge of the economy. He also

cautioned the bankers all to heed the lessons on the recent liquidity

crisis and to be mindful of the enormous challenges associated with

global financial integration.

Bangladesh Bank Executive Director Mr. Md. Ahsan Ullah offered an

in-depth look at the financial system in Bangladesh, and pointed out

key developmental themes of the country’s Central Bank, such as its

pioneering role to promote environmentally-friendly banking

practices.

Drawing on historical references, the top banker emphasized the

evolving nature of banking globally, stressing possibilities for

improving societal welfare. “Central banks have a development role,” he

stated, which should and entail close monetary and fiscal policy

coordination. Officials should strive for inclusive growth and reducing

Gini coefficients as “per capita income is not a panacea” in terms of

achieving societal happiness, he stated.

For PMBF Program Coordinator Dr. Sundar Venkatesh, the

modular program is moving forward in the right direction by emphasizing

the very highest quality. The PMBF emphasizes practice with a

strong theoretical underpinning, he said. "We conducted aptitude tests

for 100 applicants from Bangladesh Bank, and from these sixteen were

taken."

Students are also regulary exposed to senior experts and speakers who

conduct real monetary policy, he stressed, and

the program includes faculty members from many of

Thailand and India's finest universities, apart from AIT. Not

content with the program's success so far, Dr. Venkatesh said he

is investigating different delivery models for the PMBF which

began in 2011, such as in-country instruction and online

learning.

First Secretary, Embassy of Bangladesh; Mr. Daw Tenzin; Mr. Fazle

Karim, AIT Extension;

H.E. Mr. Kesang Wangdi; Dr. Jonathan

Shaw;

Mr. Md. Ahsan Ullah;

and Dr. Sundar Venkatesh, PMBF Director,

AIT.